Trump coin to process Binance investment

Plus Zoltan Pozsar makes an appearance at Token 49 in Dubai

DEALS

— Reuters reported on Thursday that Donald Trump's World Liberty Financial stablecoin will be “used by” an Abu Dhabi investment firm for its $2 billion investment in crypto exchange Binance.

World Liberty aims to allow people to access financial services without intermediaries like banks by launching USD1, a dollar-pegged stablecoin backed by U.S. Treasuries, dollars, and other cash equivalents. The associated token is WLF1.

Abu Dhabi-based MGX is expected to invest $2 billion in Binance.

— After originally rejecting Ripple’s $5 billion offer to acquire Circle, unconfirmed rumors were circulating on Thursday that Ripple’s Brad Garlinghouse was looking to increase the offer by up to 4x.

INDUSTRY EVENTS

— Dubai’s Token 2049 event boasted an impressive lineup of industry leaders this week, from Tether’s Paolo Ardoino and Pantera Capital’s Dan Morehead to American entrepreneur Balaji Srinivasan. The key headliner, Eric Trump used the event to float bold predictions about the decline of core banking. “If banks don’t watch what’s coming, they’ll be extinct in 10 years.”

Also making an appearance on stage under Chatham House rules was former Credit Suisse analyst Zoltan Pozsar, now heading his own research firm Ex Uno Plures. The usually media-shy “dollar plumbing” expert reportedly told the audience that “stablecoins will become the new medium of eurodollar expansion”.

Cash Equivalence understands that Steve Miran, Trump’s chair of the Council of Economic Advisers, has attributed a number of the ideas he floated in a November paper that prompted market speculation of a Mar-a-Lago Accord to Pozsar.

MARKET STATS

— An anonymous cryptocurrency wallet that holds $2 billion worth of USD1 received the funds between April 16 and 29, according to data from crypto research firm Arkham.

— USD1’s market cap hit over $2 billion this week.

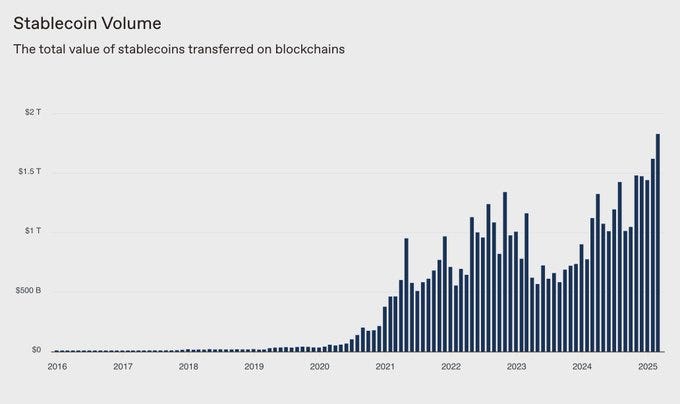

— A16Z said stablecoin transaction volumes hit $1.82 trillion last month, a record high.

— An analyst note from Citi predicted that total outstanding supply of stablecoins could grow from $230 billion to anything from $1.6 trillion to $3.7 trillion by 2023, Finextra reported.

— Tether’s latest quarterly attestation for Q1 2025 revealed that the group has $143.6 billion in total issued USDt, and $149.3 billion in total assets/reserves.

The group’s deposits are now overcollateralized to the tune of $5.6 billion in liquid assets. The group holds some $120 billion in U.S. Treasuries (direct and indirect exposure), and boasted $1 billion in operating profits in the first quarter. Overall supply increased by $7 billion. New wallets increased by 46 million, an increase of 13 percent that now brings total wallets to 415 million. The group achieved an average of $30 billion in average daily volume.

“Across our portfolio of companies, we're seeing promising progress in expanding our boots on the ground presence, already in the millions of physical touch points, with a 10x projection for the next 5 years, allowing Tether products to reach almost 3 billion people,” said Paolo Aroino, CEO of Tether.

REGULATION

— U.K. Chancellor Rachel Reeves revealed the government's long-awaited proposals for crypto regulation on Tuesday, which for the time being will not apply to stablecoins.

The latest framework follows the publication of detailed proposals in October 2023 for a financial services regulatory regime for cryptoassets, including stablecoins. At the time, the proposals looked to create a new regulated activity of issuing fiat-referenced stablecoins in the U.K., and to amend the Payments Services Regulations 2017 directive to bring payments using these stablecoins within the regulatory perimeter for payments. Beyond this, the plan was to regulate stablecoins, including those issued in the U.K., in the same way as crypto assets.

But now, the legislation will move ahead without amending the PSR 2017 to bring U.K.-issued stablecoins into regulated payments at this time.

“This does not mean that stablecoins cannot be used for payments in the U.K., but simply that they will remain unregulated for payments for the time being. The government considers that stablecoins have the potential to play a significant role in both wholesale and retail payments, and stands ready to respond to this as part of wider payments reforms as use-cases and user adoption develops over time.”

While the scope of the new regulatory framework for crypto has now been set, the details are yet to be determined by the Financial Conduct Authority and the Prudential Regulation Authority.

INTELLIGENCE

— Cash Equivalence understands that the U.K. is not keen to alienate stablecoin capital, with regulators now guiding against any policies that might make London a less attractive venue for related activities.

QUOTES

“The growth we’re seeing in stablecoin use, whether for everyday payments or cross-border transfers, shows that people trust digital currencies that are stable & predictable.” - Paxos Head of APAC, Jeannie Lim.

Further reading

The boosters:

SEC drops investigation into PayPal’s stablecoin — Coin Telegraph

The neutrals:

Visa and Bridge launch stablecoin-backed cards across Latin America — CoinTelegraph

The hostiles:

Eric Trump travels to Dubai to sell property and crypto — Semafor

Keep reading with a 7-day free trial

Subscribe to Cash Equivalence to keep reading this post and get 7 days of free access to the full post archives.